Ready for the 2015 MLB All-Star Game?

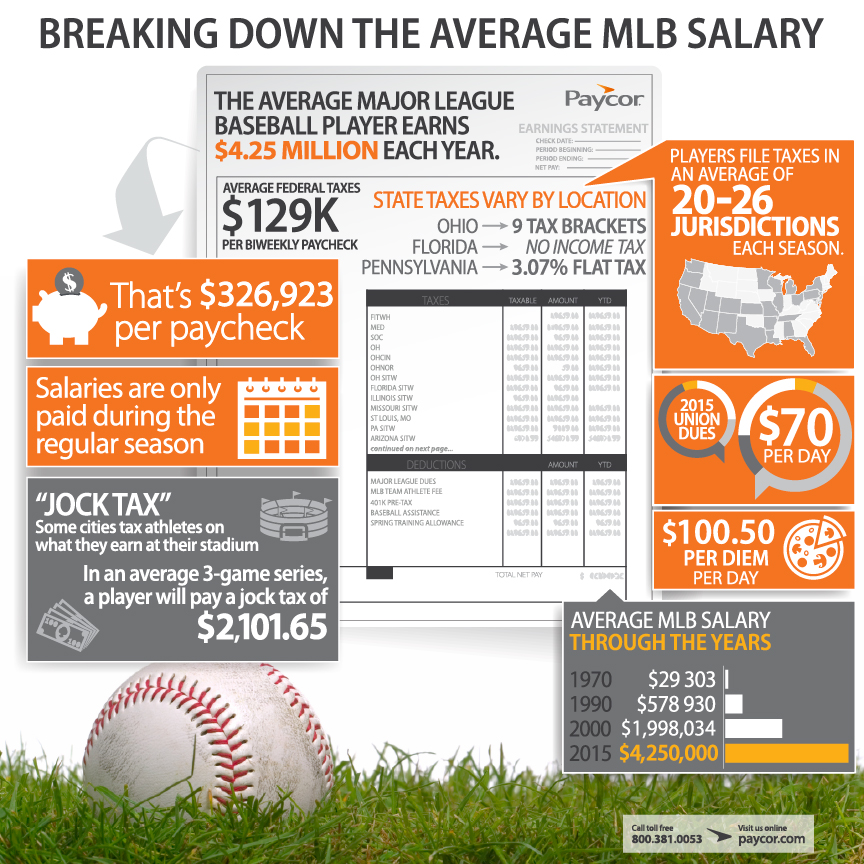

With the 86th Major League Baseball All-Star Game right around the corner, we got to thinking. Did you know that the average MLB player is required to file taxes in 20-26 jurisdictions? This means keeping up-to-date on regulations at both the state and local level. Add in required Federal taxes, a varying list of deductions and you have one complex paycheck.

And remember, that’s only one player. Imagine being responsible for calculating paychecks for a roster that includes over 50 players, coaches and support staff. Talk about complicated.

As the official payroll and HR provider for the Cincinnati Reds, Paycor is trusted to manage the complexities of a Major League Baseball paycheck. For the past 13 years, our dedicated team of specialists has demonstrated the ability to handle the most intricate payroll and tax filing scenarios. If Paycor can deliver this type of accuracy for the host team of the MLB All-Star Game, imagine what we could do for you!